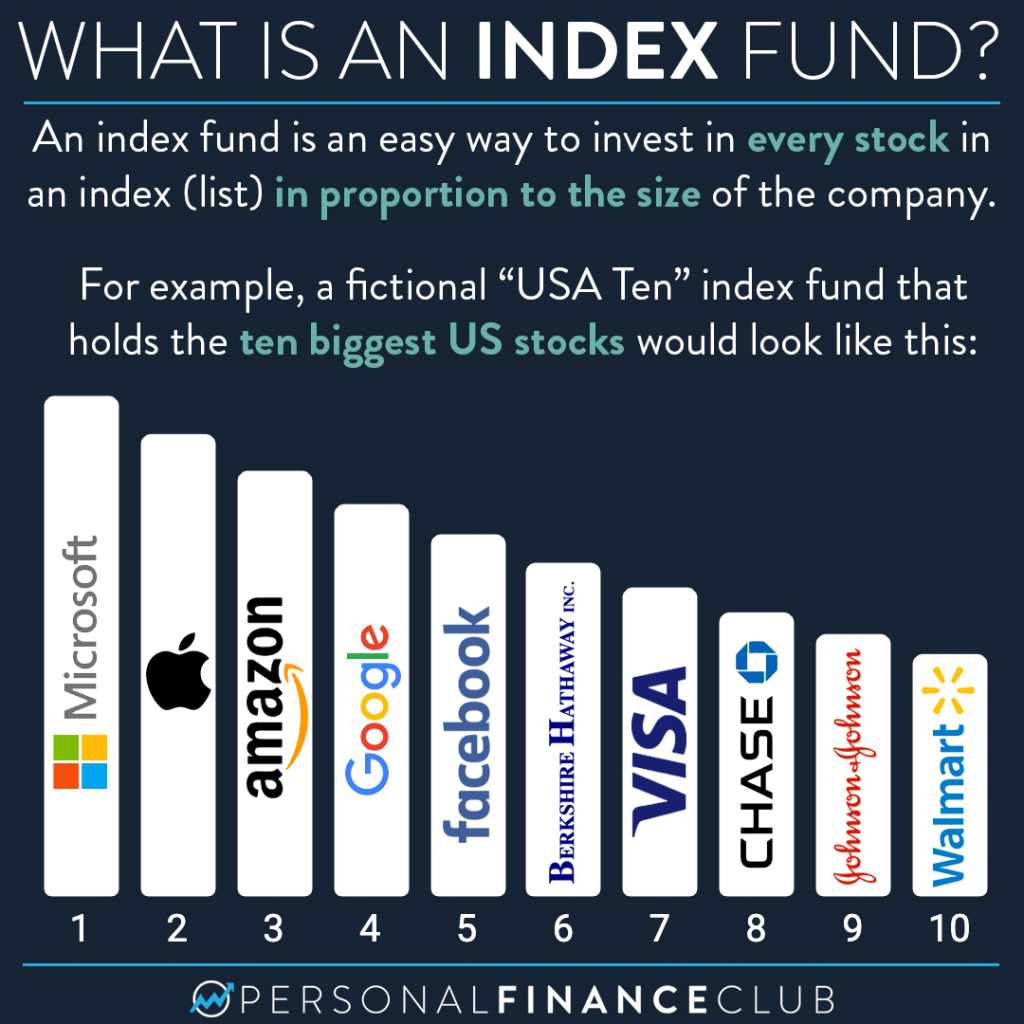

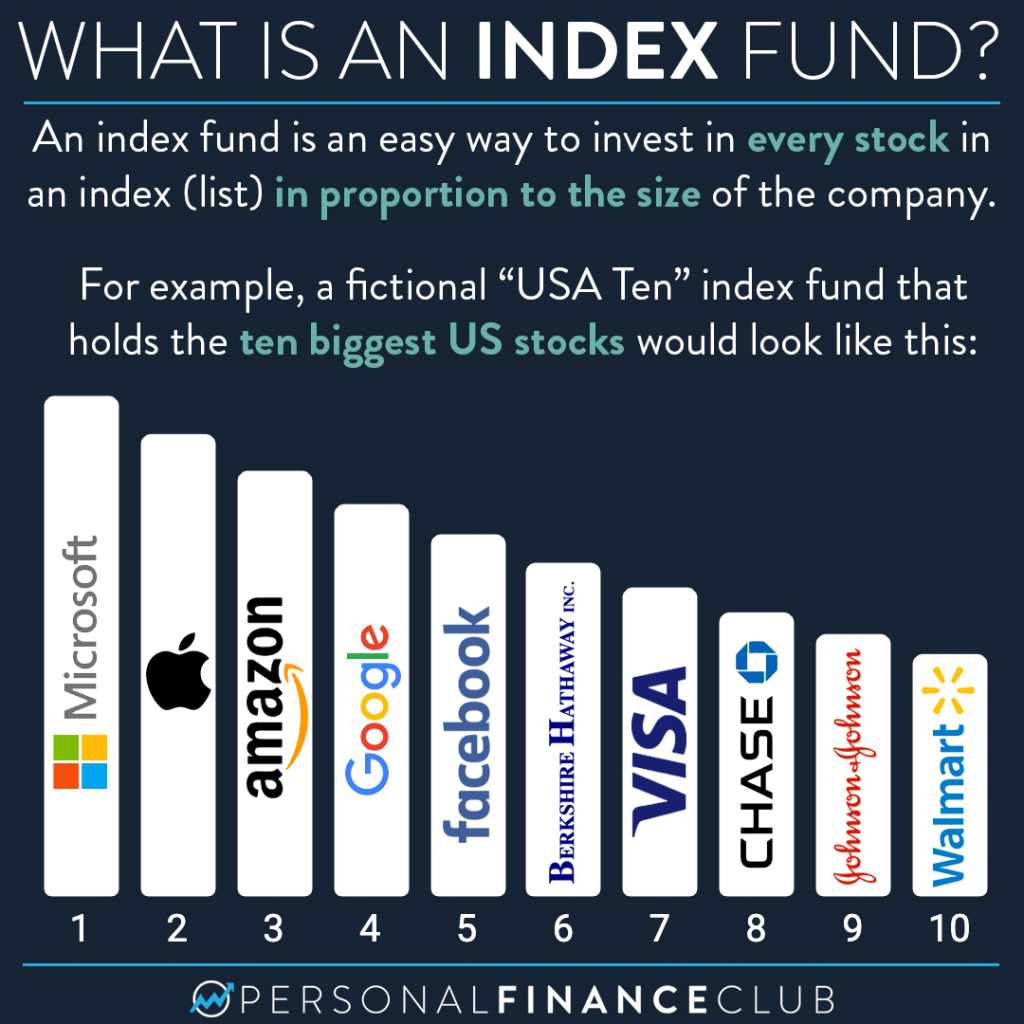

what is an index fund

Learn about our Financial Review Board. Ad We researched it for you.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

The Hidden Differences Between Index Funds

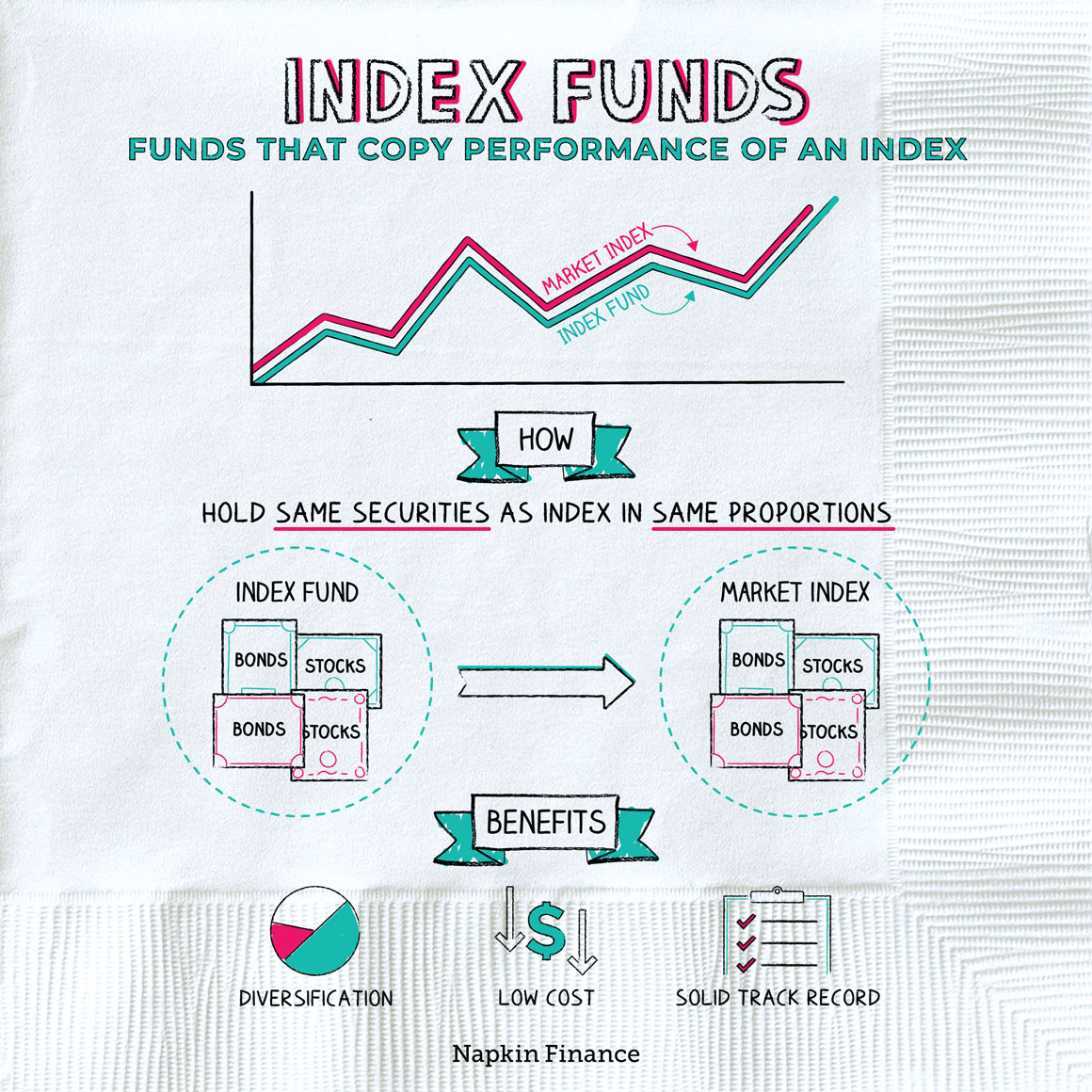

An index fund is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index.

. Index funds are a type of mutual fund or exchange-traded fund ETF that are made up of stocks or bonds. An index mutual fund or ETF exchange-traded fund opens a layer layer closed. Index funds are investments made up of stocks that mirror the companies and performance of a market index such as the SP 500.

These are passively managed funds which means that the. This means the scheme will perform. An index fund is a type of mutual fund whose holdings match or track a particular market index.

Find out with this free guide. This index may be created by. Index funds are investment funds that follow a benchmark index such as the SP 500 or the Nasdaq 100.

Ad Safe Retirement Planning. The SP 500 Index the Russell 2000 Index and the Wilshire 5000 Total. Six Pitfalls Of Funds from Fisher Investments offers insights on ETFs mutual funds.

Make Your Money Work Smarter And Get Guaranteed Monthly Income For Life. Index Funds Index Fund Mutual Funds Best Index Funds. As the name suggests an Index Mutual Fund invests in stocks that imitate a stock market index like the NSE Nifty BSE Sensex etc.

An index fund also index tracker is a mutual fund or exchange-traded fund ETF designed to follow certain preset rules so that the fund can track a specified basket of underlying. Mutual Funds Retirement Investing Solutions. Comparison for Index Funds.

Ad Choose From Over 70 Funds With 4 5 Star Ratings From Morningstar. The term index fund refers to the investment approach of a fund. Ad Are ETFs or index funds a good way to grow your nest egg.

Specifically it is a fund that that aims to match the performance of a particular market. Learn About Our Approach. Index funds typically invest in all the components that are included in the.

The Balance Jamie Knoth. Index funds are passively managed and. These funds purchase all the stocks in the same proportion as in a particular index.

Ad Choose From Over 70 Funds With 4 5 Star Ratings From Morningstar. An index fund is an investment that tracks a market index typically made up of stocks or bonds. Index funds as the name suggests invest in an index.

An index fund is an investment fund either a mutual fund or an exchange-traded fund ETF that is based on a preset basket of stocks or index. Learn About Our Approach. Screen compare over 30000 funds across the industry.

Index funds are mutual funds or ETFs whose portfolio mirrors that of a designated index aiming to match its performance. What Is an Index Fund. Find Out What You Need To Know - See for Yourself Now.

Index funds are passively managed mutual funds that try to duplicate the performance of a financial index like the SP 500 or the Dow Jones Industrial Average. Tracks the performance of a specific market benchmark or index like the popular SP 500 Indexas. Personalised Reports Get the Highest Guaranteed Return.

Mutual Funds Retirement Investing Solutions. When you put money in an index fund that cash is then used to invest.

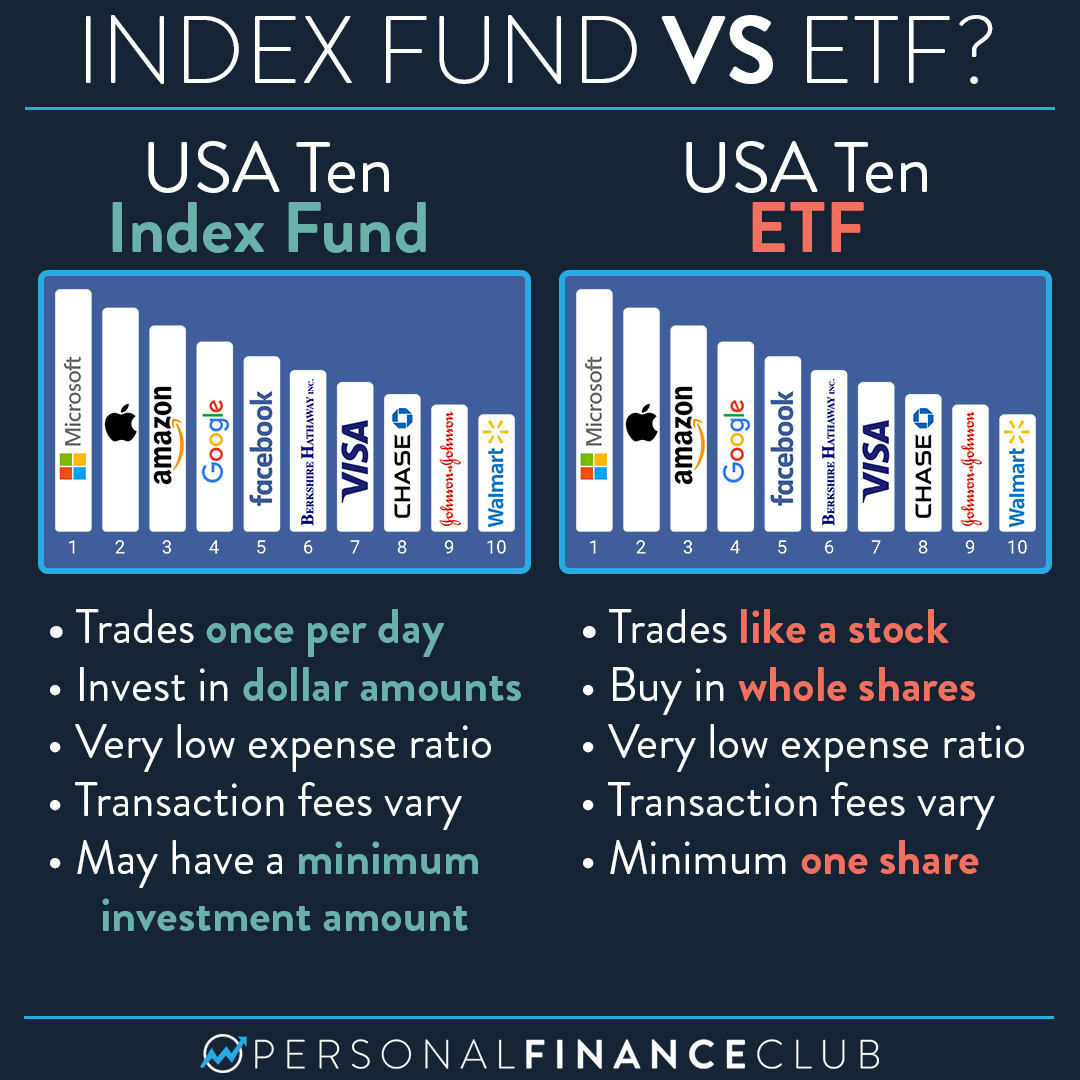

What S The Difference Between An Index Fund And An Etf Personal Finance Club

What Is An Index Fund Personal Finance Club

What Is An Index Fund Index Funds Definition Napkin Finance Has Your Answers

What Is An Index Fund How Does It Work

/index-funds-vs-etfs-2466395_V22-d288a73d28154c3c9df884f076f2f6af.png)

Etf Vs Index Fund Which Is Right For You

What Is Index Fund Meaning Capital Com

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png)

0 Response to "what is an index fund"

Post a Comment